All-encompassing payments orchestration layer directly connected to your core and embeddable in most digital banking apps

From real-time payments to emerging payment rails, handle it all through one unified platform

Instant transfers via FedNOW, RTP, and other real-time payment networks

Support for global payment systems across multiple countries and regions

Future-ready with support for stablecoins and tokenized deposits

Direct integration with your core banking system for seamless operations

Seamlessly integrate into most digital banking applications

Support for both domestic and cross-border payment processing

Empower underserved and underbanked communities with instant-issue card products that provide immediate access to modern payment capabilities—no waiting, no barriers.

Issue virtual cards instantly upon account opening—members start using payment services immediately

Serve populations without traditional bank accounts or credit history

Flexible card types including prepaid, debit, and secured options for all credit profiles

Apple Pay, Google Pay ready—digital-first access for smartphone users

Expand financial inclusion while growing your member base in underserved demographics

Card issued in <60 seconds

Add to wallet immediately

Load funds and start spending

Send money internationally with real-time foreign exchange conversions, competitive rates, and instant settlement across 180+ countries

Instant currency conversion at competitive market rates with transparent pricing—no hidden fees

Send payments to virtually anywhere in the world using local payment rails for fast, cost-effective delivery

Real-time processing means your members' international payments arrive in minutes, not days

Choose country and enter amount in USD

See exact foreign currency amount + fees

Payment routed via optimal rail

Funds arrive in recipient's local currency

Transparent Pricing: Members see all fees upfront before confirming

USA to

Mexico (MXN)

USA to

Philippines (PHP)

USA to

India (INR)

USA to

EU (EUR)

USA to

UK (GBP)

USA to

Brazil (BRL)

USA to

Canada (CAD)

And

170+ More

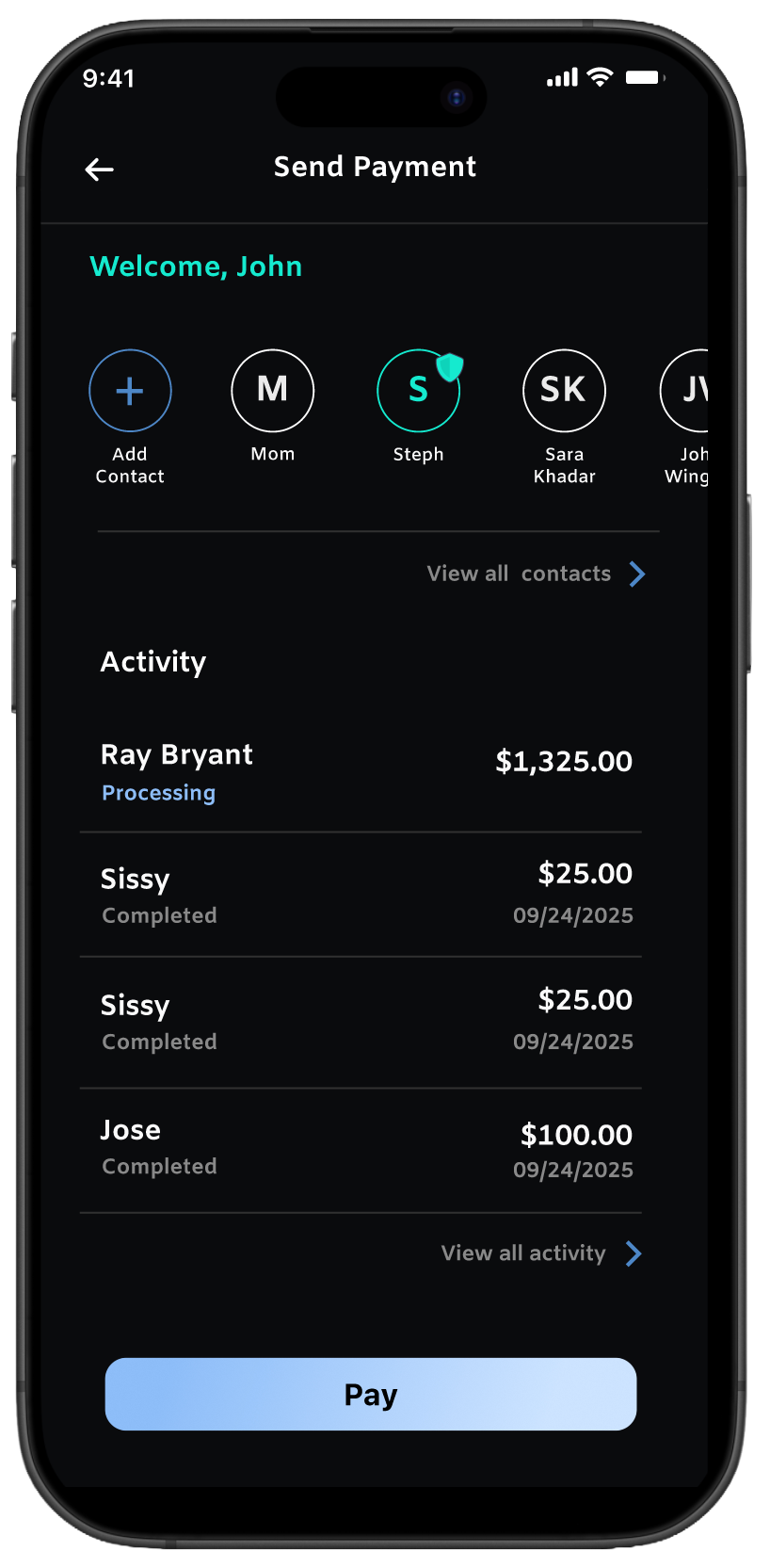

A seamless, intuitive interface that consolidates all payment types into a single, cohesive experience. Whether sending, receiving, or requesting money domestically or internationally, your members enjoy the same familiar flow.

Members can send OR request payments via QR codes, links, and more

Same look and feel across all payment methods

Automatically select the best payment rail

Fully customizable to match your brand

Empower your members to request payments instantly via QR codes and leverage open wallet infrastructure for seamless interoperability across platforms

Your members can generate instant payment request QR codes that anyone can scan to pay them—perfect for merchants, service providers, or person-to-person transactions.

Generate payment request QR codes in seconds with custom amounts or open amounts

Share payment request links via text, email, or social media for easy remote payments

Perfect for businesses to accept payments without expensive POS hardware

Instant alerts when someone scans and pays your payment request

Built on open standards allowing members to connect to multiple wallets and payment platforms, creating a truly interoperable payment ecosystem.

Connect with other digital wallets and payment platforms through open APIs

Members can link external wallets for seamless fund transfers and management

Native support for crypto wallets and DeFi protocols when enabled

Built on industry standards for maximum compatibility and future-proofing

QR code payment requests and open wallet infrastructure give your members the flexibility and convenience they expect in today's digital-first world—all while keeping transactions secure within your institution's ecosystem.

Convert digital assets to spending power instantly with our integrated payment solutions— use crypto anywhere cards are accepted or pay directly with QR codes

Get a physical or virtual debit card linked to your crypto holdings. Spend Bitcoin, Ethereum, and other digital assets anywhere Visa or Mastercard is accepted.

Pay directly with crypto at participating merchants using QR codes. No card needed— just scan and pay with your preferred digital asset.

Crypto automatically converts to local currency at the best available rate

Use anywhere in the world with automatic currency conversion

Bank-grade security with fraud protection and purchase insurance

// Initialize Remint API

const remint = new RemintAPI({

apiKey: 'your_api_key',

environment: 'production'

});

// Send real-time payment

const payment = await remint.payments.send({

amount: 150.00,

currency: 'USD',

recipient: {

accountNumber: '1234567890',

routingNumber: '021000021'

},

rail: 'FEDNOW',

description: 'Payment via API'

});

// Track payment status

const status = await remint.payments

.track(payment.id);Financial Institutions can leverage Remint's powerful APIs to build completely custom payment experiences that perfectly match their brand and user experience requirements.

Complete API access to all payment rails and features

Stay synchronized with instant payment status updates

Detailed guides, SDKs, and code examples for faster integration

Test and develop without risk in our full-featured sandbox

A next-generation stablecoin designed specifically for financial institutions, offering multi-chain accessibility with seamless integration into your existing core banking and digital infrastructure.

Deploy across multiple blockchains for maximum reach and flexibility

Direct integration with your core system for real-time settlement and reconciliation

Purpose-built for loan servicing, lending programs, account opening, and automated funding workflows

Seamlessly works with your digital banking infrastructure and payment rails

Launch your own branded stablecoin for business and community use cases

Built with compliance and institutional standards at the forefront

1 rUSD = 1 USD

Take full control of your revenue model with flexible fee structures, thresholds, and limits tailored to your institution and member types

Daily Limit

Configurable

Transaction Max

Configurable

Monthly Cap

Configurable

Min. Amount

Configurable

Daily Limit

Configurable

Transaction Max

Configurable

Batch Processing

Enabled

API Access

Available

Daily Limit

Higher Tiers

Transaction Max

Higher Tiers

Priority Support

Included

Fee Discounts

Custom

Your institution sets the rules. Configure fee structures, limits, and thresholds through an intuitive dashboard or programmatically via API. Changes take effect immediately.

Schedule a DemoRemint integrates with leading payment rails, blockchain networks, and financial infrastructure worldwide

One platform, unlimited connectivity. Remint seamlessly orchestrates across traditional payment rails and next-generation blockchain networks.

Every payment is secured by Secura®, our hardened wallet infrastructure layer

Advanced risk isolation ensuring each transaction is protected independently

Multi-layered access controls and permissions for all transaction types

Comprehensive security framework from consumer to business accounts

Bank-grade security with multi-signature support, cold storage options, and real-time fraud detection

Advanced fraud detection powered by facial recognition, core banking integration, and third-party AI systems working together in real-time

Advanced biometric verification using facial recognition to confirm user identity before processing transactions

Direct access to your core banking data enables behavior analysis and pattern recognition across all accounts

Integrate with leading fraud detection platforms to leverage global threat intelligence and shared learning

All three AI systems work together in real-time, creating multiple layers of fraud detection that adapt and learn from each transaction to protect your institution and members

All BankSocial products work together seamlessly to create a complete financial services platform for your institution

Wealth creation platform for stocks, crypto, and digital assets management

Payment orchestration for real-time, international, and emerging payment rails

Fraud protection and hardened wallet infrastructure with enterprise-grade security

Streamlined onboarding and account opening with identity verification

All BankSocial® products are designed to work together seamlessly, giving your financial institution a complete, integrated solution for payments, security, wealth management, and customer onboarding. Deploy individually or as a complete suite.

Join leading financial institutions and credit unions leveraging Remint™ to deliver seamless payment experiences