A complete digital wallet infrastructure designed specifically for community financial institutions. Deliver modern banking experiences while maintaining full control and compliance.

All products accessible from one seamless interface

Native apps and responsive web experience

Completely customized to your institution's brand

Regulatory requirements handled automatically

The future of autonomous transactions is here. AI agents tied directly to wallets and accounts, enabling seamless, intelligent commerce on behalf of your members.

AI agents securely linked to member wallets and accounts with granular permission controls. Agents act on behalf of users while maintaining full security and compliance.

AI agents execute payments, investments, and transfers based on member-defined rules and preferences. Smart commerce that runs 24/7 without constant supervision.

Members set spending limits, transaction types, and approval workflows. AI agents operate within defined boundaries with real-time monitoring and override capabilities.

Deploy Wallet infrastructure however it works best for your institution and members

Seamlessly integrate Wallet capabilities directly into your existing digital banking platform. Your members never leave your environment.

Launch a dedicated Wallet app or web experience as a companion to your core banking services. Perfect for new product launches.

Integrated with leading providers across banking, payments, technology, and blockchain

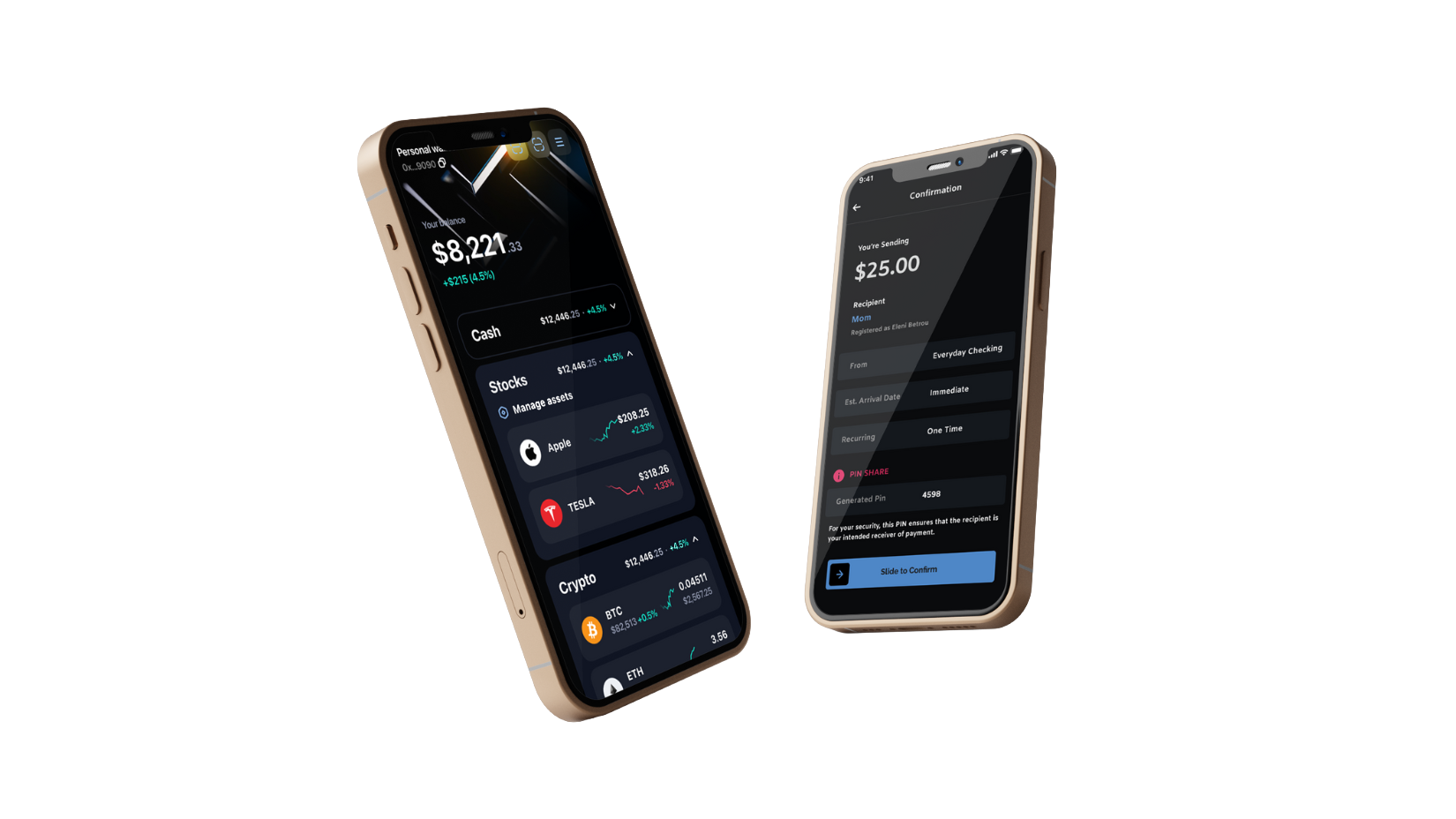

Wallet delivers all four BankSocial products in one seamless member experience

Investment & Digital Assets

Enable members to invest in stocks, ETFs, and digital assets directly through your institution. Full brokerage capabilities with compliance built-in, custodial crypto wallets, and real-time portfolio tracking—all within the Wallet experience.

Payments Hub

Unified payments across ACH, RTP, FedNow, wire, card networks, stablecoins, and digital rails. P2P transfers, bill pay, request money, scheduled payments, tokenization, and merchant services— all orchestrated through a single, elegant member interface.

Fraud Protection & Recovery

Real-time fraud detection, prevention, and recovery tools embedded in every transaction. Member-facing dispute resolution, automated claims processing, chargeback management, and scam protection—keeping your members and institution safe.

Identity & Account Opening

Streamlined digital account opening for personal, youth, and business accounts. KYC/AML compliance, portable identity, identity verification, document collection, decisioning workflows, and account provisioning—onboard new members in minutes, not days.

Granular controls that protect your consumers and your FI—without sacrificing the modern experience they expect

Set daily, weekly, and monthly limits by user type, account type, and product. Separate limits for Youth, Adult, and Business accounts.

Youth accounts with parental oversight, spending limits, and restricted access. Automatic graduation to adult features at configurable age thresholds.

Built-in KYC, AML, and BSA compliance. Automated reporting, audit trails, and configurable workflows that meet federal and state requirements.

Velocity checks, pattern detection, and real-time fraud monitoring. Configurable risk thresholds integrated with Secura for immediate response.

Turn products on/off by account type. Launch Prospera for adults only, enable Remint for all users, or restrict features by membership tier.

Multi-level approval processes for high-risk transactions. Route Business account requests through Nuron for employee review before execution.

Fully white-labeled to match your institution's brand identity and member expectations.

Choose which products to enable, set limits, and configure experiences for your members.

Deploy in weeks, not months. Start with one product and expand as your strategy evolves.