Every transaction flows through multiple security checkpoints, ensuring comprehensive protection at every step

Advanced risk isolation ensuring each transaction is protected independently with tailored security measures

Multi-layered access controls and permissions ensuring only authorized actions are executed

Comprehensive security framework from youth accounts to business wallets, all protected equally

Machine learning models analyze patterns in real-time to identify and prevent fraudulent activity

Built-in recovery mechanisms to reverse fraudulent transactions and restore member funds quickly

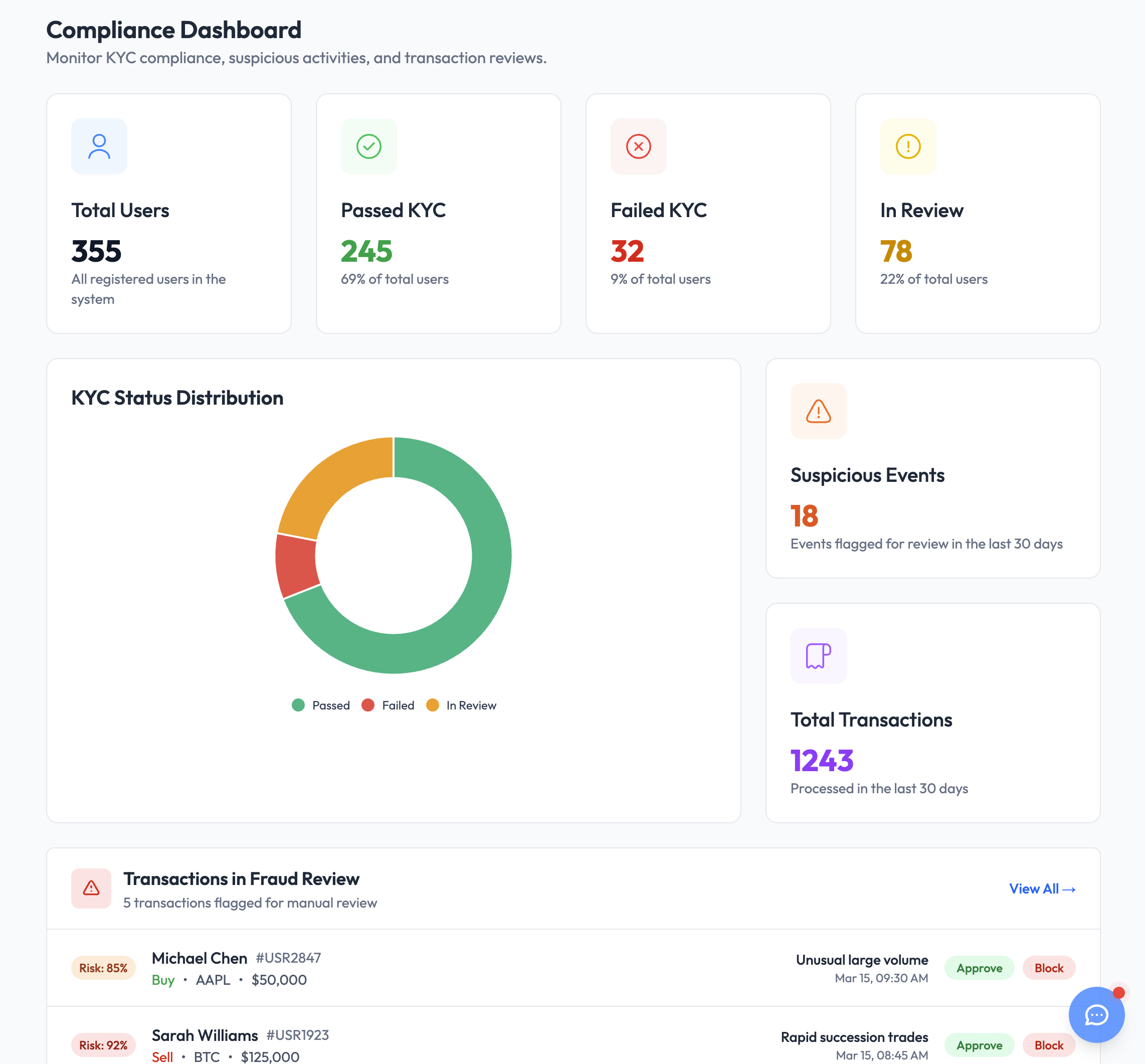

Built to meet and exceed banking regulations, including KYC, AML, and BSA requirements

Secura provides the secure wallet layer that powers all transactions across Remint, Prospera, and Wallet—ensuring every dollar, every asset, and every transaction is protected.

Require multiple approvals for high-value or sensitive transactions

Offline storage for long-term asset protection and maximum security

Military-grade encryption protecting data in all states

0 threats detected in last 30 days

Secura meets and exceeds all regulatory requirements for financial institutions, providing full compliance with KYC, AML, BSA, and OFAC regulations.

Full know-your-customer and anti-money laundering compliance built-in

Real-time screening against global sanctions lists

Complete BSA compliance with automated reporting

Complete transaction history and compliance documentation

Industry-leading blockchain analytics and screening partners provide comprehensive visibility and compliance across all payment rails

The world's leading blockchain data platform for investigations, compliance, and risk management across cryptocurrency transactions.

Advanced blockchain intelligence platform providing risk scoring, fraud prevention, and compliance tools for digital assets.

Real-time endpoint verification and fraud screening for instant payments through the Federal Reserve's FedNow Service.

Every transaction is screened against global sanctions lists, fraud databases, and risk indicators before execution

Active monitoring tracks fund flows across blockchains and payment rails to detect suspicious patterns instantly

Continuous analysis identifies emerging threats and provides forensic trails for investigations and compliance reporting

Reactor provides real-time visualization of transaction paths and fund movements, making it easy to trace illicit activity across complex blockchain networks.

Visualize connections between wallets, exchanges, and entities

Follow funds through multiple intermediary addresses

Identify high-risk entities and exposure levels instantly

Generate compliance-ready documentation for regulators

Powered by Chainalysis Reactor - Industry-leading blockchain analytics

See how Secura instantly screens wallet addresses against global sanctions lists, fraud databases, and risk indicators

Click "Scan Wallet" to see instant fraud screening in action

Intelligent AI assistants provide instant, expert guidance on security, compliance, and fraud prevention—available 24/7 through natural conversation.

Trained on banking regulations, AML requirements, and fraud detection best practices

Ask questions in plain language and get expert-level answers instantly

Always available to assist with security inquiries and compliance questions

Understands your institution's specific needs and regulatory environment

See how AI copilots provide instant expert guidance on security and compliance

Our proprietary machine learning models continuously learn and adapt to emerging fraud patterns, protecting members from sophisticated scams before they happen

AI agents analyze transaction patterns, messaging behaviors, and relationship timelines to identify and prevent romance scams and pig butchering schemes in real-time.

Advanced models detect sophisticated money laundering techniques including transaction structuring and mule account networks through cross-account pattern analysis.

In-house machine learning models combined with multi-factor authentication create an impenetrable defense against unauthorized account access.

Secura's fraud detection seamlessly combines with Verifiied's identity verification to create a comprehensive defense from onboarding through every transaction.

Our agentic AI system doesn't just detect known fraud patterns—it discovers new ones, adapts to emerging threats, and becomes more effective over time through continuous learning.

All BankSocial products work together seamlessly to create a complete financial services platform for your institution

Wealth creation platform for stocks, crypto, and digital assets management

Payment orchestration for real-time, international, and emerging payment rails

Fraud protection and hardened wallet infrastructure with enterprise-grade security

Streamlined onboarding and account opening with identity verification

All BankSocial® products are designed to work together seamlessly, giving your financial institution a complete, integrated solution for payments, security, wealth management, and customer onboarding. Deploy individually or as a complete suite.